Numerous technological innovations have recently emerged with the potential to redefine the insurance industry. From integrating with wearable fitness trackers and rewarding activity goals to customer support chatbots that understand and respond in natural language, technology is constantly changing the way that insurers interact with their customers.

According to a recent study by McKinsey1, technology trends in AI and automation will have the biggest impact on the life insurance industry. While these are broad solutions, it is now in the hands of insurers to apply these trends in a way that retains their competitive edge in this lucrative industry.

The Challenges

The past three years have caused a major shift in operations across all industries, and the US life insurance sector is no exception. While some changes are positive, they often uncover new challenges and force companies to transform business processes from sales to underwriting and claims to adapt to the customers' needs.

There was significant growth in life insurance sales during 2020 and 2021 as customers became more aware of life protection and financial risks, but not all insurers were able to leverage this opportunity to gain a competitive advantage, especially in areas where strict social distancing measures were imposed. Then as pandemic mandates have lifted, the challenge has shifted towards retaining these customers and maintaining the sales momentum.

Tech-savvy customers nowadays tend to desire a seamless experience when selecting any service especially after experiencing unprecedented life events in recent years. Thus, when it comes to insurance, customers are more likely to purchase products from insurers who offer a real-time quote/buy/claim process as these are among the most important touchpoints. This increasing demand is driving Insurers to automatize and digitalize their existing manual processes.

The Solutions

Sales

For insurers offering complex products to older and wealthier individuals as their target market, it is increasingly essential to have a system enabling remote sales engagement. This allows prospects to securely access online meetings with financial professionals via a link and password shared by email and/or SMS.

During the appointment, this digital touchpoint enables customers to share documents or information instantly upon the request of agents or brokers. Other noteworthy features include audit logs to ensure the authenticity of the documents and a recording function to capture the meeting as evidence in the event of a dispute or litigation.

To tackle the challenge of retaining loyal customers, insurance companies should adopt a prediction model that integrates with their core system and calculates how likely a customer will let their policy lapse. This model can leverage AI technology to identify trends in customers' personal information and historical transactions and offer reliable predictions about the likelihood that each customer will let their policy lapse. Using this data, the customer service team can identify those with a higher likelihood of lapsing their policy to focus on engaging them with better services and care.

Underwriting

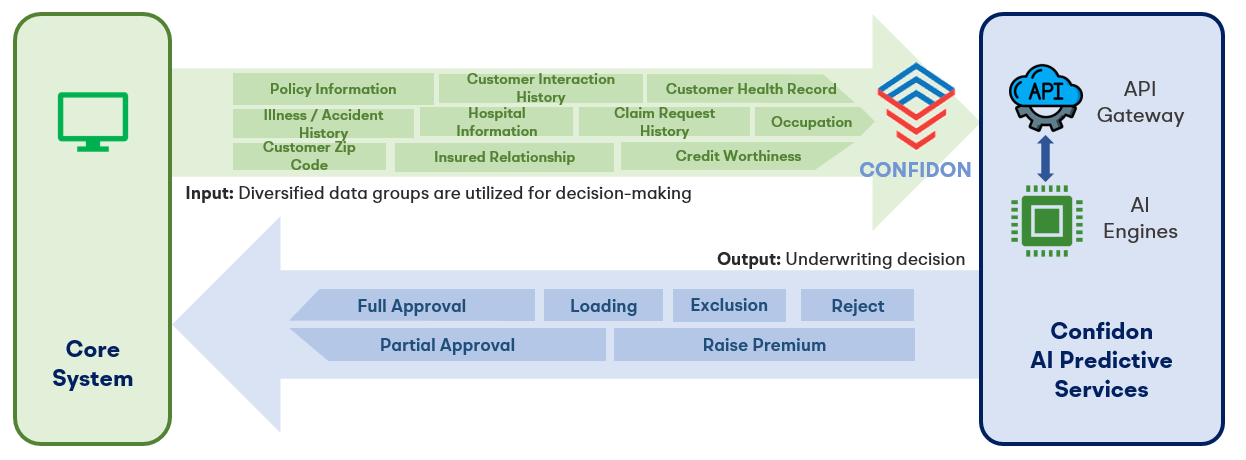

Intelligent automation is one of the most effective ways to streamline the policy underwriting process. It combines rule-based task automation with AI components to enable immediate underwriting decisions and enhance the customer experience.

Automated underwriting begins by configuring the automatic rule engine using predefined criteria like age, sum insured, or premium. Then using the massive historical data of past underwriting decisions, insurers feed it into their AI-based underwriting system to train the model. This system learns from all the past customer and policy data and uses it to produce evaluations for new applicants. If cases are escalated for manual review, it also learns from these outcomes to improve its decision-making algorithm.

Additionally, companies should consider having a customer portal to allow customers to check the real-time underwriting status of their applications and provide additional information if requested. For example, customers can receive notifications about medical documentation requests and submit the results directly in the system.

Claims

Regarding the claims submission process, insurers should consider implementing a customer-facing digital touchpoint that leverages advanced technologies including OCR (Optical Character Recognition). This approach enables customers to submit their claim seamlessly by taking a photo and all the necessary data is extracted, recorded, and transmitted to the core system automatically for back-office processing.

Then during claim processing, instead of having a human intervene to review claim requests individually, an automation rule engine with AI technology can automate each step of the claim process. By learning and analyzing all historical claim data, this system can make decisions automatically for claim entries matching all required criteria. For more complex scenarios, it can give the Claim Adjuster suggestions on requisite information needed to proceed with the claim.

Confidon

Utilizing experience from solving these and similar pain points for the insurance industry, FPT built an AI-based, custom solution called Confidon which applies intelligent automation to manual tasks in the sales, underwriting and claim processing workflows.

This advanced solution includes a specific array of features that insurers should evaluate during their digital transformation plan. For example, it can expedite the underwriting turnaround time from 20 minutes per policy to approximately 2 seconds. Other turn-key and custom solutions are also available to suit the specific needs of each business.

Figure 1 – Confidon Underwriting Data Flow

Figure 1 – Confidon Underwriting Data Flow

The considerations

Data privacy

Data privacy has always been a crucial issue for life insurance companies, as they handle their customers’ data. KPMG's survey shows that 47% of consumers fear their data could be hacked, and 51% fear it could be sold2. Such concerns have the potential to impede the progress of data and technology innovation for insurers.

To improve customer trust and confidence, insurers should implement safety strategies such as multi-factor authentication, API keys and checksum hashes, firewall and intrusion detection, and regular penetration testing.

Underwriting decisions using AI

According to research from McKinsey3, cutting-edge AI technologies such as language processing and text mining, can process up to 90 percent of applications. However, the remaining 10 percent still require human intervention. Therefore, while AI does streamline the underwriting process, it can’t completely replace human judgment- which is essential to ensure fair treatment for all applicants.

For straightforward cases, AI can support automated decision-making according to learned historical data. However, when the AI engine detects any abnormalities in complex applications, these should be always directed to underwriters for reviewing manually and making the final decision. Additionally, AI algorithms trained on historical data may contain inherent biases. To avoid perpetuating these biases, it is crucial to regularly audit and update the algorithms, thereby increasing the transparency in the underwriting process which helps build trust among customers and reduce concern about potential bias.

The digital claim customer experience

Despite the efficiencies of the claims process on a digital platform, insurers should also consider the importance of customer interaction. It is a challenge for many insurers to deliver the right service at the right time to satisfy the wide range of expectations from the policyholders. While some customers prefer the reliable, faster and more accurate digital claim service, others tend to choose insurers offering the ability to quickly contact claim professionals in urgent situations.

Therefore, insurers should adopt a balanced approach that offers both digital self-service and alternative emergency assistance from skilled claim professionals. This approach can ensure a smooth claiming experience, thus building greater trust and loyalty among policyholders.

Conclusion

In an ever-changing digital landscape, there will always be challenges for US life insurers to adapt and overcome. Therefore, taking a digital leap with strong technical expertise is genuinely a magic bullet for insurers.

At FPT Software, we deliver full-service insurance solutions that include AI and cutting-edge technology credentials for the top insurance firms in the world. Using our integrated suite of digital tools and outsourcing model, our experts will help to optimize costs and increase speed and agility to drive better performance. Contact us today for more information on maximizing your business' full potential.

References

- McKinsey & Company: https://www.mckinsey.com/industries/financial-services/our-insights/how-top-tech-trends-will-transform-insurance

- KPMG survey: https://www.oneinc.com/resources/blog/data-privacy-the-insurance-industrys-next-obstacle

- McKinsey & Company: https://www.mckinsey.com/industries/financial-services/our-insights/rewriting-the-rules-digital-and-ai-powered-underwriting-in-life-insurance