“Alone we can do so little, together we can do so much.”- Helen Keller

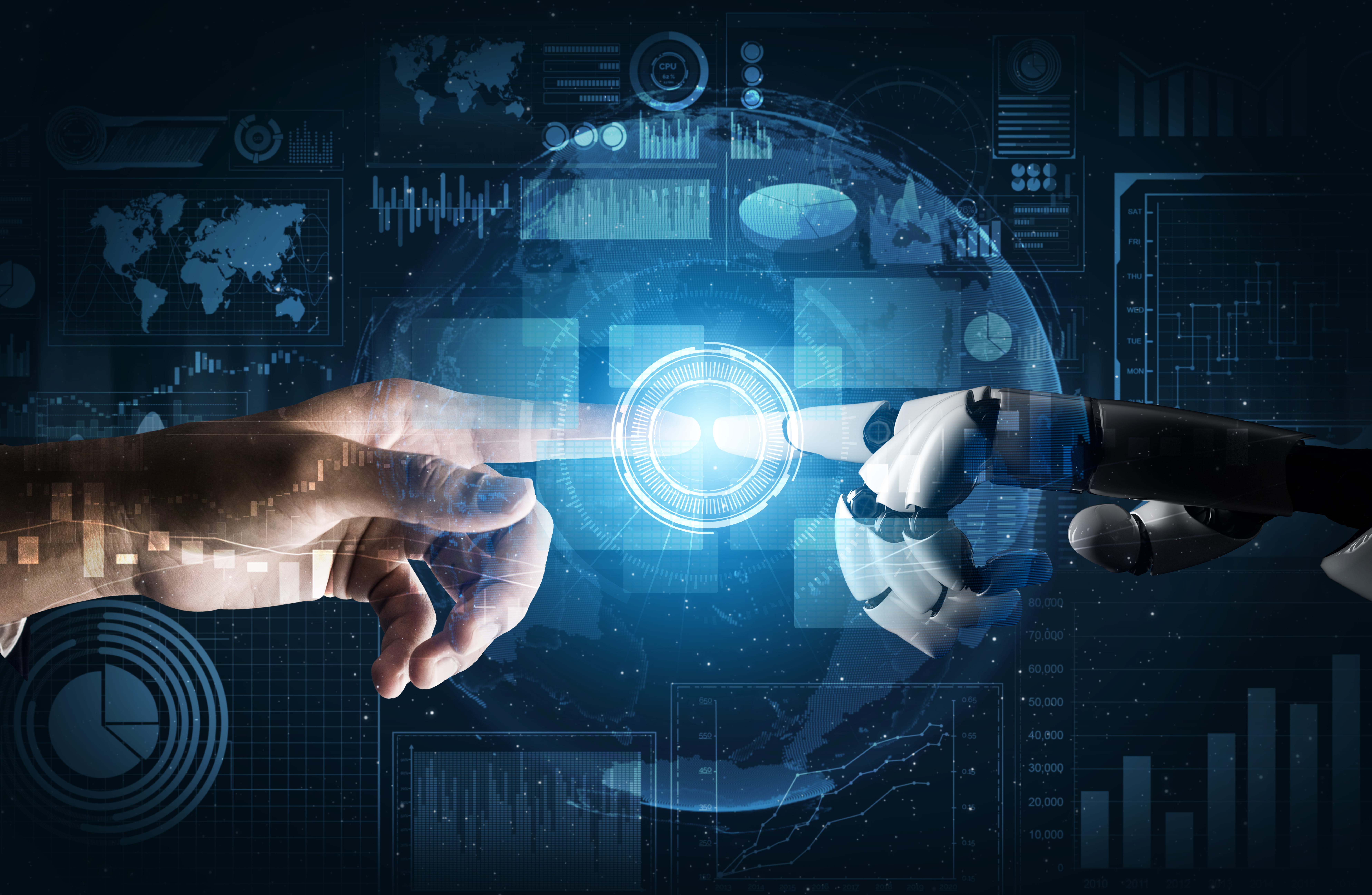

The past 20 years have witnessed a fundamental change in the financial services industry. From a sector regarded as highly resistant to technology disruption, finance has emerged as the pioneer in exploiting digital power, with hi-tech innovation spreading along the value chain. While most industriesstill struggle to replace flesh-and-blood workers with robots, trying to automate processes as much as possible; financial institutions, one more time, stay ahead by shifting its focuson the collaboration between human and machine. The concept to boost such partnership is known as Augmented Intelligence (IA).

Human expertise meets technologyforces

If the adoption of AI aims to minimize human involvement byemploying systems capable of “thinking” and “reasoning”, Augmented Intelligence is designed to supplement brainpower through the pairing of machines and people. Like any alliance, IA’s objective is achieving greater values by taking advantage of each party’s strengths. Manpowerofferscognitive ability to give feedback, guidance and adjust models to best fit reality, while intelligent tools bring unprecedented productivity and precision to the table. The forte of machine and algorithms combined with human touch is what makes IA so compelling.

The significance of Augmented Intelligence in Finance

Finance is a knowledge-intensive sector, which major tasks require the reading and understanding of large amounts of information. Artificial Intelligence, hence, cannot act alone in some instancesand human expertise is still needed – this is why Augmented Intelligence is gaining popularity among financial services providers. There are three key domains where IA solutions are already utilized in the industry.

Client intelligence: In its publication examining the future of financial services, PwC stated that consumer intelligence would be the most crucial factor of revenue growth and profitability.IA creates a new kind of experience that financial organizations can offer and satisfy customers’ demands.The system learns from clients’ behaviour and transaction data to figure out their individual preferences, expectations and risk appetite, allowing for evermore tailored, personalized services that best suit them.

For example, robo-advisors provide investment recommendations by merging customers’ information with the right asset allocation that qualifies their needs. When allocations fall outside of certain criteria for the specific client, AI-based system will trigger the involvement of human advisor.On the one hand, robo-advisors offer users a more customized, cost-effective alternative. On the other, they freeup human workers from administrative tasks torefocus on gaining trust and addressing insecurities of buyers - qualities thatno machine can provide. Financial planners, in turn, can adopt the optimal approach based on a complete 360-degree view of customers given by machine peers.

Risk and compliance: Machine intelligence can recognize patterns, detect anomalies to give early warnings or flag fraudulent activities. Employees then use this machine data, apply their judgment and expertise to interpret the findings and make a final call. As finance is an industry of extremely complicated nature with multiple rules and laws, the adoption of IA also enhances financial institutions’ regulatory compliance. By automating document analysis, IA assists compliance professionals to investigate more quickly and make more informed decisions.

Since 2017, JPMorgan has been using a platform called COIN (Contract Intelligence) that “analyze legal documents and extract important data points and clauses”. The software reviews in seconds the number of contracts that previously took lawyers over 360,000 hours. This investment has also improved the quality of the contract review process, as the algorithm is less error-prone than human lawyers.

Trading: The intelligent systems are not only capable of executing trades but also spotting opportunities and provide insights to make it easier for traders to realize.They analyze data on competitors, partners and markets to track economic trends, make projections, and run simulations to determine the best scenarios. For instance, banks are using AI-based system to recommend the best rate swaps for a firm’s balance sheet, or seek correlations among assets prices and other data to predict currency prices. Humans then can guide and define what makes a good trade and help the system evolve.

Overall, IA is playing a crucial role in improving financial institutions’ operation. As American author Helen Keller put it “Alone we can do so little, together we can do so much”, the quote initially was to describe the power of teamwork among people. Yet, in case of Augmented Intelligencein financial services, the saying remainstrue for thecollaborative relationship between machine and human.

Talk to our experts and discover how to leverage Augmented Intelligence!

References

1. PwC (2016). Financial Services Technology 2020 and Beyond: Embracing disruption [Link]

2. IBM (2017). Augmented Intelligence in banking. [Link]

3. Bloomberg (2017). JPMorgan Software does in seconds what took lawyers 360,000 hours.[Link]